Stamp Duty Calculator… How much extra will buyers have to pay?

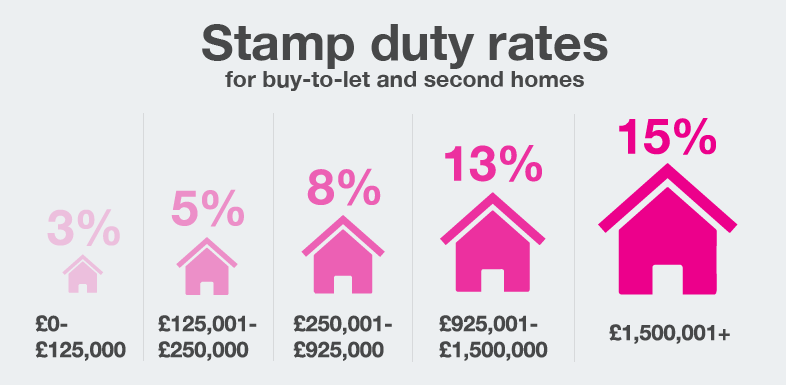

From 1 April 2016, buyers who complete transactions on a second home or buy-to-let property, i.e. any property that will not be your main residence, is liable to pay an additional 3% on each tier of Stamp Duty.

Stamp Duty Calculator

How much extra will buyers have to pay?

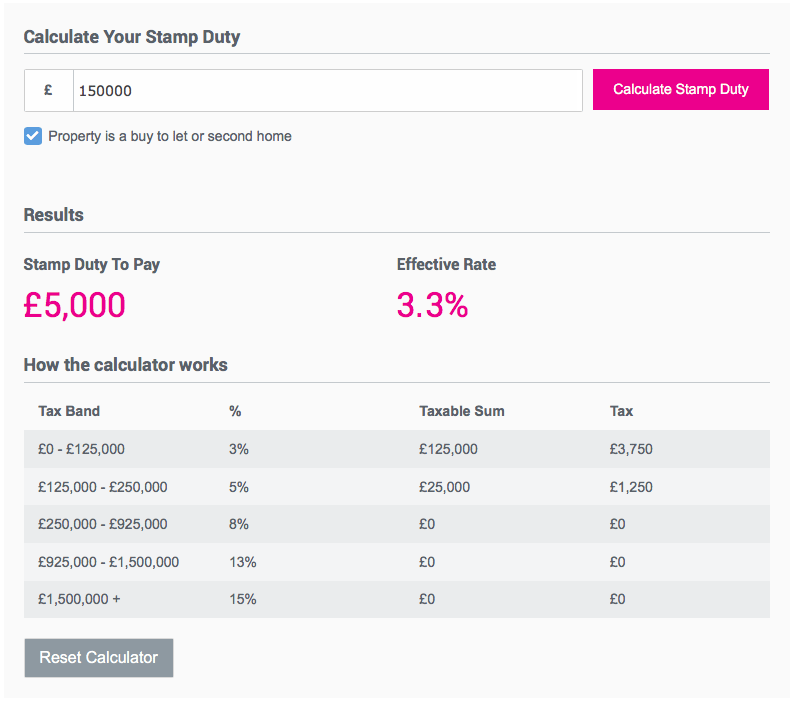

Try our handy Stamp Duty Calculator… click the form below to be redirected or follow http://www.goldingsauctions.co.uk/stamp-duty-calculator to find out how much tax is payable.

Source : HMRC

How to calculate the new Stamp Duty rate for a second home or investment purchase:

If you purchased a property for £150,000 you would incur 3% stamp duty up to the first £125,000, followed by 5% on £125,000 to £250,000 (e.g.: 3% of £125,000 + 5% on the £25,000 difference = £3,750 + £1,250 = £5,000 SDLT to pay). As the value of the property increases, the amount due increases in line with a specific tax bracket, the percentages increasing once a higher tier value is established.

When is Stamp Duty due?

Stamp Duty charges must be settled with HMRC 30 days from the property transaction completion date, or you may risk being fined. Your solicitor or legal adviser should take ownership of this for you to make certain the deadline is not missed. Certain buyers opt to add on the SDLT figure to their mortgage loan. We recommend that you always seek further advice from your mortgage lender.

Who pays Stamp Duty?

Stamp Duty is incurred by everyone purchasing a freehold, leasehold or shared ownership residential property that exceeds £125,000 in England, Northern Ireland and Wales (other rules apply to Land and Buildings Transactions Tax in Scotland), if it’s a property used as a primary residence and with no minimum if the property or land is a second home/investment. These regulations also apply to overseas buyers.