Author: Tim Golding

Auctioneer’s note…

“Another very well-attended auction with regular and new buyers bidding strongly on an interesting mix of Lots.

We are delighted to announce that Lot 9, 151 Dover Road, Ipswich, was sold in the room straight after the sale and The Chapel, Mendlesham Green, sold post auction today. This means that the sale success rate for our Summer auction stands at 100% for all Lots offered.

One property in particular that performed well was the bungalow requiring modernisation in Benfleet, Essex. I was certainly kept on my toes…with the opening bid starting at £200,000 the atmosphere was electric, balancing the needs of a packed saleroom full of buyers, a commission bid from one client and two registered telephone bids. The eventual sale figure of £325,000 exceeded everyone’s expectations.

With all of our Vendors pleased with their positive outcomes, we can draw another successful line under this Summer sale and focus our full attention on continuing to deliver exciting, diverse and prosperous auction Lots.

If you missed the auction and would like to watch the Live Stream recording, please visit here(Auction Video).

We look forward to everyone coming together again in the room and online on 30 September.”

Tim Golding – Auctioneer

The first quarter of 2015 has delivered a record result for UK property purchased by cash-only buyers reaching nearly 4 in 10.

A post on the BBC News website shows figures for the proportion of cash buyers released by Nationwide, peaking at 38%, an increase of 2% on the average for 2014. This has largely been attributed to the recent tightening of mortgage lending and historically low and competitive interest rates.

According to Nationwide’s data, it appears that the impact of the financial crisis had almost instantly contributed to the number of cash transactions, without a requirement for a mortgage, shooting up dramatically.

The Chief Economist at Nationwide, Robert Gardner, explains that cash transactions would not have been affected by tighter credit controls or high unemployment:

“Continued healthy demand from cash buyers has helped to support transaction levels in recent quarters, since mortgage lending has remained relatively subdued.

“For example, in Q1, overall housing transactions were down by around 5% compared with Q1 2014, while mortgage completions were around 11% lower.

“The significant rise in the share of cash transactions occurred in the wake of the financial crisis, where a tightening in credit conditions and a deterioration in the labour market limited the number of people able to buy with a mortgage.

“The low interest rate environment is likely to have supported the flow of cash into other asset classes in recent years, including UK residential property.”

Comparing Nationwide’s regional statistics from 2013, the East of England matched London by hovering around the national average mark of 36%, whereas the North East had the biggest share of cash buyers at 50%, followed by the South West.

The BBC’s post can be read here.

The link to Nationwide’s latest House Price Index Report is here.

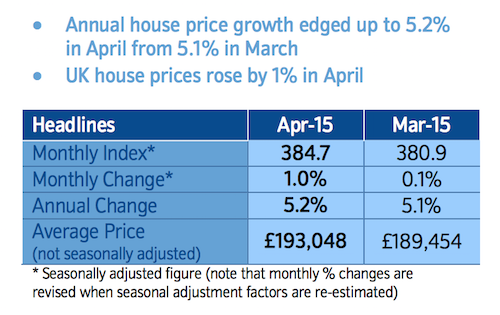

UK house prices are continuing to rise, according to the world’s largest building society Nationwide.

Being one of the nation’s biggest mortgage providers, Nationwide reports that between the months of March and April, the housing market gathered pace and produced a 1% rise, the largest monthly increase since June last year. For the first time in seven months, a figure of 5.2% growth has also been recorded.

Nationwide’s Chief Economist, Robert Gardner, commented:

“The pick-up in price growth has occurred even though the pace of activity in the housing market has remained fairly subdued in recent months. Indeed, the number of mortgage approvals is still well below its long run average and 20% below the levels recorded in early 2014.“

The strength of the economy and relatively subdued pace of activity in the housing market remains something of an anomaly. It is possible that heightened uncertainty ahead of the election is weighing on activity, though there is no compelling evidence from previous UK elections to suggest a strong impact.

“Healthy labour market conditions and continued low mortgage rates should help underpin housing demand in the quarters ahead.”

According to Capital Economics, the monthly increase was “strong” and they projected a 6% price rise this year. Matthew Pointon, Capital’s Property Economist affirmed the this growth and said:

“Record high employment, combined with record low mortgage rates, means the conditions are in place for further price gains this year”.

For our region, East Anglia saw a quarterly rise of 1.1% and a 7.8% increase for the last 12 months, although this measure has softened slightly from 9.8%.

Experts advise cash savers to invest their money elsewhere…

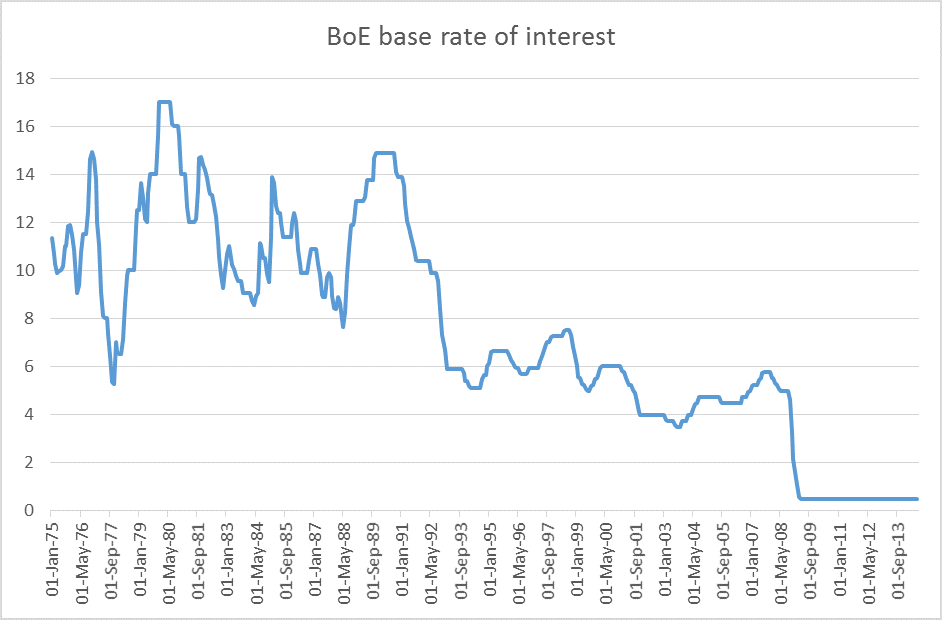

With the six-year anniversary of historically low UK base interest rates standing firm at 0.5%, things are looking rosier for the economy, but savers and investors are clearly losing out.

The Bank of England kept the base rate (the “price” of money) at historic lows of 0.5% this year

A recent article posted on FE Trustnet’s website quoted Alex Doctor-Huran, a savings and investment expert at BlackRock:

“Cash makes people feel safe and so we hold too much of it. If you are saving with income generation in mind, you need to own less cash when rates are this low and inflation, even at 0.5 per cent, is eating away at your money in the long-term.”

“People are aware they hold too much cash. As the end of the tax year approaches, savers should think about using their ISA allowance to take steps out of cash and seek more effective ways in which their savings can provide an income to make their money work harder for them.”

Therefore, it’s no shock that financial gurus are recommending that people with disposable cash should really be looking elsewhere to maximise returns.

To add fuel to the fire, there is always varied speculation on when and if interest rates will rise or even fall for that matter.

At the back end of 2014, the steep decline in the rate of inflation at 1%, lower than the 2% target, together with the dilution of economic recovery, means experts now predict a potential rate rise may not appear until August 2016.

The Telegraph reports that further years of low rates could be on the horizon influenced by the true picture of Britain’s economic recovery, state and consumer debts and the demise of an economic boom underpinned by baby boomers now in retirement.

Global forces are also creating deflationary effects, with the Eurozone heading into deflation, the oil prices tumbling 50% since Summer 2014 and Japan’s policy on devaluing its currency, which could impact world markets.

At a record low 0.5% since March 2009, markets predict it is likely this figure will remain until July or August 2016 compared to a rate rise in March 2015, which was originally forecast the beginning of the New Year.

The report from FE Trustnet can be read here.

Click here for the Telegraph’s analysis.

The Guardian reveals that the former childhood residence of Beatle, Sir Paul McCartney, sold via auction for £150,000 reaching £50,000 above the top guide price. The property auction was held on 26 February at the remodelled Cavern Club in Liverpool.

McCartney described the terraced house as “the first house I can remember”, having moved into the home at the age of four in 1947 and living there with his family for six years.

The Auctioneers said that interest in such a unique Lot was generated worldwide and although the successful buyer chose to remain anonymous, it was confirmed that the person in question hailed from the UK.

Andrew Brown, Managing Director at Countrywide Property Auctions commented: “We are delighted to have sold such an iconic piece of The Beatles and Liverpool’s history”.

It goes without saying that Beatles memorabilia is popular and always sells well, which is supported by the track record from the sales of John Lennon’s and George Harrison’s former homes.

The Guardian article can be read here.

The NAEA has reported that over-ambitious asking prices following October 2014’s Stamp Duty reforms have not been achieved for almost three-quarters of houses sold in January 2015, a 17% rise versus the same period last year, which could be a sign of a slowdown in the property market.

The NAEA’s January housing market report shows that supply was down to 44 properties per member estate agency compared to an average of 47 for 2014 and 45 in December. However, buyers are re-energising their negotiation skills amidst the reduction in supply and demand.

NAEA member agents experienced that 73% of homes sold below their asking price in January. Compare this with a year ago when 56% of homes were sold under their marketing price.

Demand fell to a 10-month low, with the average number of applicants on NAEA member records decreasing from 360 to 353 between December and January.

For first-time buyers, 44% of sales were attributed to the 31-40 year-old category, 18-30 year-olds totalled 39%, while buyers over 41 reached 17%.

NAEA figures show that on average in January, 8 houses sold per branch compared with a seasonal low of 5 in December.

Mark Hayward, NAEA Managing Director commented:

“The Autumn Statement’s stamp duty reforms have already created movement. Following this, sellers may have hiked up prices to take advantage of buyers’ increased budgets. “But it seems buyers are counteracting this by negotiating prices back down.”

However this report is not a true reflection of what is going on in the UK property market and at Goldings Auctions, we are certainly bucking the trend. Our 25 February 2015 sale realised a 100% sale success, with properties on average reaching 15-20% above reserve. Moreover, our list of registered buyers is growing exponentially with over 8,000 subscribers worldwide.

After landing on a property, if a player refuses to buy it, the correct way is to offer it for sale by auction.

Monopoly has been frustrating players since 1935 due to its drawn-out gameplay – following the proper rules can be a game-changer, saving time by offering a speedy conclusion, thus maintaining that element of excitement.

The original rules for Monopoly, if followed correctly, can prevent many a family row and shorten the often-lengthy game time. A rarely practised and ‘hidden’ rule vent viral on the social networking site Twitter after a games blogger promoted a mission to teach the world how to play the game properly.

The true rules of Monopoly dictate that if a player lands on a space such as Mayfair but doesn’t wish to continue with the purchase, an auction must ensue. Creating competitive bidding pushes a different player to buy a space, thus speeding up the game.

Skipping this little-known rule means it could be potentially hours before someone else lands on Mayfair

again to buy it.

The world record for the longest Monopoly game in history lasted for 1,680 hours, that’s 70 straight days.

Buying property at auction is a transparent, proactive, timely and often lucrative means to securing your ideal investment within budget. Long gone are the drawn out processes and risk of everything falling through last-minute, often experienced through private treaty sales.

Auction is a great way to create competitive bidding to maximise the value of a property and the best way of bringing motivated buyers and sellers together. When the hammer falls, contracts are exchanged, which is legally binding – the property is sold unconditionally. However, buying through auction must not be underestimated and as such, research is key.

Here are ten tips, which may help your decision-making:

Property Search…

Finding auction properties is easy via The Essential Information Group eigroup.co.uk – “the one stop shop for all property auctions and auction related material around the UK”.

Devote time to studying the auction catalogue…

Catalogues are usually available online and free of charge. It’s no good just turning up on Auction Day and randomly bidding on properties – this is a risky strategy to follow. It may get the adrenaline pumping relying on that ‘gut feeling’, but being prepared is the way to go.

Go and physically visit the property…

Don’t make the mistake of buying a property “blind”. Ad hoc viewing appointments are rare, so published open viewings are held in line with a viewing schedule. Always attend your chosen property in person at least once – having a builder/architect tag along can be useful.

Conduct thorough research…

It goes without saying that detailed research is a pre-requisite to buying at auction. Find other similar properties or examples that might be on the market with local Estate Agents and complete an exercise to compare price and condition. Remember, prices set at auction are only a guide, so work out what the true market value really is and bid realistically.

Read the Legal Pack…

You can register interest in a property with the Auctioneer by requesting a Legal Pack. This information can be requested online via eigroup.co.uk and may contain copies of the Title Deeds, Special Conditions of Sale, Land Registry Search, Leases (if applicable) and other relevant documents. You must inspect these, or even better employ the wisdom of a solicitor.

Ensure finances are in place…

On Auction Day, you will pay a 10% deposit of the hammer price and the remaining balance must be settled within 28 days. For those requiring a mortgage, a formal mortgage offer must be in place rather than a mortgage offer in principle. Contact your lender and talk things through – it’s best practice to confirm the financial implications associated with a purchase.

Prepare yourself…

For novices, buying at auction can be overwhelming. There’s really nothing to be worried about, as the process is uncomplicated. The best plan of action is before going to bid for real, do a trial run as an observer just to familiarise yourself with the process and set expectations.

Proof of ID and other info…

Part of the buying procedure involves providing identification to satisfy legislative requirements: proof of identification, i.e. photo ID, e.g. Driving Licence/Passport and proof of UK residency e.g. utility bill/Council Tax bill/mortgage statement. Also ensure that you have your Solicitor details at hand and funds to cover the 10% deposit, payment via cheque/card.

When bidding time comes…

It is important that your bids are acknowledged, so do make sure that the Auctioneer can see you and is aware when you bid. Raise your hand or catalogue to maintain attention.

Stick to your budget…

With the intense competition and bidding activity experienced at auctions, it is often easy to get carried away as the bidding increases – don’t let your heart rule your head when securing that perfect property! Setting a budget beforehand and sticking to it is a winning formula.

You didn’t get it?…

If the property you were bidding on failed to meet its reserve price during the sale, don’t worry, it’s not all over just yet. The Auctioneer can work with you and the Vendor as an agent in order to finalise a deal post auction. Bargains can often be had if handled correctly.

There are no substitutes for property auctions – if you want certainty of sale, you’re in the right place. If the process is followed in the right way, the risk is low and worry-free and the experience is thrilling and totally satisfying when a bid is accepted. At the end of the day you may get the steal of the century at the same time…what’s the worst that could happen…?